What is Andrew Fastow's Net Worth?

Andrew Fastow is an American convicted felon who has a net worth of $2.5 million. Andrew Fastow infamously served as the CFO of Enron Corporation from 1998 until he was fired shortly before the company filed for bankruptcy in 2001. An SEC investigation found that he and several other key figures were behind a massive accounting scam that concealed Enron's huge losses and defrauded the company out of tens of millions of dollars. He was later indicted by a federal grand jury in 78 counts including fraud, money laundering, and conspiracy.

Fastow pled guilty to two charges, and in return for a lighter sentence he became an informant to assist the prosecutions of other former Enron executives. Fastow was consequently sentenced to six years in prison, five of which he ended up serving. Fastow's wife Lea who was a former Enron assistant treasurer was sentenced to one year in a federal prison in Houston in 2004. In addition she also served one additional year of a supervised released after pleading guilty to a misdemeanor tax charge.

Former Enron CEO Jeff Skilling served 12 years of a 24-year sentence. Ken Lay died in 2006, three months before he was scheduled to be sentenced. Meanwhile, their former colleague Lou Pai is worth hundreds of millions of dollars and is one of the largest landowners in Colorado, all thanks to an affair with a stripper.

Salary & Settlement

During his time at Enron, Andrew Fastow made tens of millions of dollars in the form of salary, bonuses and stock-based compensation. Even as the fraud was collapsing, in the company's final year Andrew earned $5.6 million. As part of his plea agreement, he agreed to forfeit $23 million.

Early Life and Education

Andrew Fastow was born on December 22, 1961 in Washington, D.C. to Jewish parents Joan and Carl. He was raised in New Providence, New Jersey, where he attended New Providence High School. In school, Fastow participated in student government, tennis, and band. For his higher education, he went to Tufts University, graduating in 1983 with a BA in economics and Chinese. Fastow went on to earn his MBA from Northwestern University.

Continental Illinois

After graduating from Northwestern, Fastow worked for the Continental Illinois National Bank and Trust Company in Chicago. While there, he worked on the burgeoning asset-backed securities practice, which soon became popular in the financial industry for creating revenue while moving assets off of a bank's balance sheet. However, in 1984, Continental became insolvent, making it the largest US bank to fail up to that point in time.

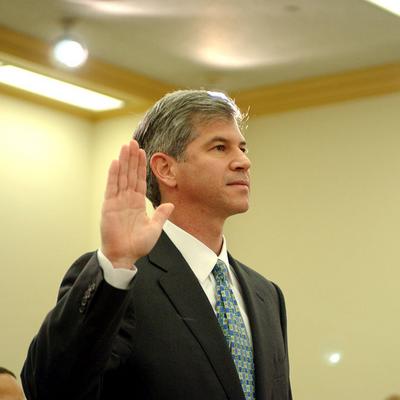

(Photo By Douglas Graham/Roll Call/Getty Images)

Enron Corporation

In 1990, Fastow joined Enron Corporation, an energy, commodities, and services company based in Houston, Texas. Hired by CEO Jeffrey Skilling as an account director, he quickly climbed the ranks within the company, and in 1998 became the CFO. In an effort to keep Enron's stock price up while concealing the company's true financial conditions, Fastow and other key figures at Enron created a complex system of off-balance-sheet special-purpose entities that Enron controlled. The aim was to raise money for the company while hiding its huge losses on its quarterly balance sheets. Although it owed over $30 billion at the height of its debt, Enron was able to show a debt-free balance sheet due to Fastow and his associates' fraudulent accounting machinations. Meanwhile, Fastow had personal financial stakes in the ghost entities he created, allowing him to defraud Enron out of tens of millions of dollars.

In the summer of 2001, Jeffrey Skilling, who had become CEO of Enron earlier in the year, abruptly resigned. After that, Enron began to collapse. Fastow was heavily scrutinized for his accounting activities, leading to a series of stories in the Wall Street Journal detailing conflicts of interest arising from his partnerships and the vast amounts of money he made from them. Later, a number of banks told Enron that they would not issue loans to the company if Fastow remained in the position of CFO; subsequently, he was removed from his position by the board. It was eventually revealed that Fastow's focus on his special-purpose entities made him completely lose track of Enron's basic financial management, such as tracking the company's cash and debt maturities. As a result, the company had almost no liquidity. Enron ended up filing for bankruptcy in late 2001.

STEPHEN JAFFE AFP / Getty Images

Sentencing and Incarceration

On Halloween in 2002, Fastow was indicted by a federal grand jury on 78 counts, including money laundering and conspiracy. Later, in early 2004, he pleaded guilty to two counts of wire and securities fraud, and agreed to a ten-year prison sentence. Additionally, Fastow agreed to become an informant and help prosecute other former Enron executives. In 2006, he entered into a plea agreement involving the forfeiture of over $23 million in assets, and was sentenced to six years in prison followed by two years of probation. Fastow ended up serving five years at the Federal Correctional Institution, Pollock in Louisiana before he was released to a halfway house in Houston to finish his sentence.

Post-incarceration

After his release from prison in late 2011, Fastow began working as a document review clerk at the Houston law firm Smyser Kaplan Veselka. He has also done public speaking engagements focused on ethics and business. Fastow has spoken at the business and accounting schools of many universities, including the University of Colorado Boulder, Miami University, the University of Minnesota, the University of Southern California, and the University of Houston. Elsewhere, he is a major investor in the Netherlands-based company KeenCorp, which makes analytics and AI products for workflow management.

Personal Life

In 1984, Fastow married Lea Weingarten, whom he had met at Tufts University. The two went on to attend Northwestern University, where they both earned their MBA degrees. They also both worked at Continental Illinois in Chicago. Weingarten went on to become an assistant treasurer at Enron when her husband was the CFO. In 2004, she pleaded guilty in relation to the company's massive fraud scandal, and was sentenced to one year in prison.

Real Estate

In 1992, Andrew and Lea bought a home in Houston, Texas. They listed this home for sale in May 2024 for $2.1 million,